Payday loans are a type of short-term, high-interest loan intended to cover unexpected expenses or financial emergencies until the borrower’s next paycheck. These loans are often sought after by individuals facing cash flow problems or those with poor credit histories who struggle to secure traditional loans. eLoanWarehouse offers a slightly different approach by focusing on installment loans as an alternative to traditional payday loans.

Table of Contents

How Does eLoanWarehouse Work?

eLoanWarehouse simplifies the borrowing process with a quick and easy online application. Borrowers start by entering their personal details, desired loan amount, and income information. Once submitted, the system verifies the data, and if approved, the borrower electronically signs the agreement. Loans are typically disbursed directly into the applicant’s bank account within one business day. This fast process makes eLoanWarehouse appealing to people needing immediate cash for emergencies.

The company operates on an installment loan model, unlike traditional payday loans, allowing borrowers to repay over several months. This feature helps borrowers manage their finances better by breaking repayments into smaller, more manageable installments. The amount a person can borrow increases with loyalty tiers—starting with smaller amounts for new customers and growing over time based on repayment history. This structure rewards consistent payments and promotes financial responsibility.

Eligibility Criteria for eLoanWarehouse Loans

To qualify for a loan from eLoanWarehouse, borrowers need to meet specific criteria. Applicants must be 18 years or older, have a steady income source, and maintain an active checking account to receive loan disbursements. Additionally, individuals must provide identification, such as a driver’s license or state-issued ID, to verify their identity. These straightforward requirements make it accessible for those with poor credit histories to still secure financial assistance.

However, some restrictions apply. Active-duty military members and their families are not eligible for loans from eLoanWarehouse. The company also limits availability to certain states due to varying lending laws. Applicants should confirm their eligibility before applying to avoid any processing issues, ensuring they meet the required conditions for approval.

Interest Rates and Loan Costs

The interest rates and loan costs for eLoanWarehouse are determined by tribal lending regulations. These rates can be significantly higher than traditional bank loans, with Annual Percentage Rates (APRs) reflecting both the interest and fees associated with the loan. Borrowers need to understand that high-interest loans can become expensive over time, especially if repayments are missed or delayed.

Transparency is key in the lending process. eLoanWarehouse outlines the total repayment amount upfront, so borrowers are fully aware of their financial obligations. However, it is essential to compare this with other loan options available in the market to make an informed choice. A careful review of the APR helps borrowers assess whether they can handle the repayment comfortably without it becoming a financial burden.

Advantages of Using eLoanWarehouse

One of the primary advantages of using eLoanWarehouse is the fast loan approval process. Borrowers often receive their funds within a day, making it a viable option for people dealing with urgent financial needs. Additionally, the company does not conduct strict credit checks, which means individuals with poor credit scores can still qualify for loans. This inclusivity makes it more accessible than many traditional financial institutions.

Another significant benefit is the flexible repayment structure. Borrowers are not penalized for paying off their loans early, allowing them to save on interest costs. This repayment flexibility encourages responsible borrowing, as customers can repay sooner if they have the means to do so, ultimately lowering their total debt.

Risks and Limitations of Payday Loans

While payday loans, including those offered by eLoanWarehouse, can be helpful in emergencies, they carry several risks. The high interest rates associated with payday loans can quickly lead borrowers into a cycle of debt if they are not cautious. Missing payments or defaulting on the loan can result in additional fees, increasing the overall loan cost significantly.

Another potential limitation is tribal sovereignty, which governs the lending process at eLoanWarehouse. As a tribal lender, the company operates under its own set of rules, which may limit borrowers’ options for dispute resolution. Customers need to be fully aware of these legal differences and ensure they understand the loan agreement thoroughly before signing.

Alternatives to Payday Loans eLoanWarehouse

For those seeking alternatives to eLoanWarehouse, several options are available. Personal loans from banks or credit unions often come with lower interest rates and more favorable terms for borrowers. Additionally, online lending platforms and financial apps like Chime or Dave offer small cash advances with minimal fees, which can be more cost-effective than payday loans.

Government assistance programs are also a valuable resource for those facing financial hardships. These programs may offer grants or low-interest loans to individuals in need, providing more sustainable solutions than high-interest loans. Exploring these alternatives can help borrowers find more affordable ways to manage their finances without falling into debt.

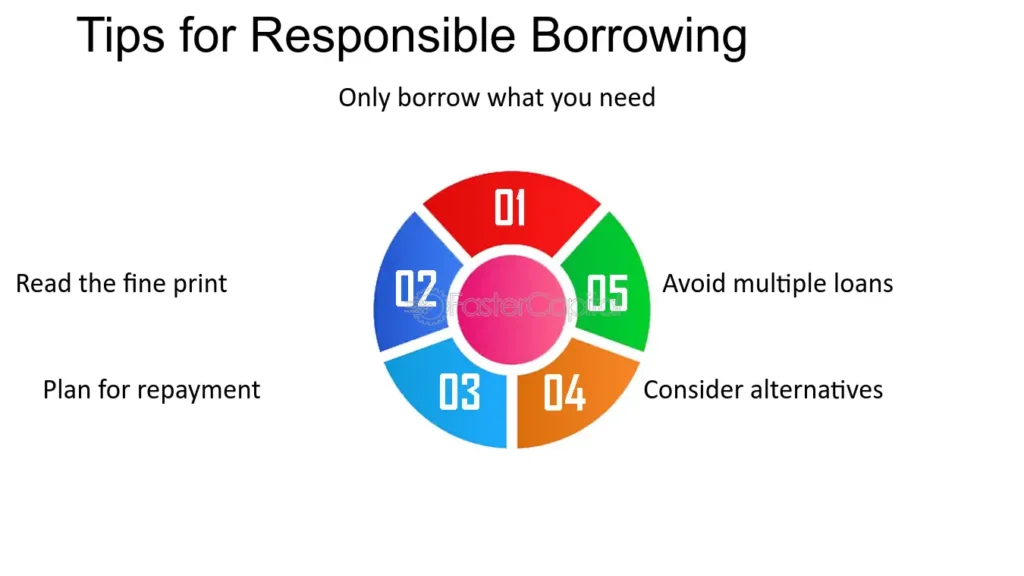

Tips for Responsible Borrowing

Borrowing responsibly is essential to avoid the pitfalls associated with payday loans. It is crucial to borrow only what is necessary and within your repayment capacity. Creating a budget that includes loan repayments can help borrowers stay on track and prevent financial stress. Setting up automatic payments is another way to ensure on-time repayments and avoid late fees.

Another essential aspect of responsible borrowing is reading the loan agreement thoroughly. Understanding the terms, fees, and interest rates ensures there are no surprises later on. Borrowers should also explore repayment plans that allow them to repay early, reducing the overall interest burden.

Read More : 127.0.0.1:62893

Customer Reviews and Experiences

Customer reviews offer valuable insights into the services provided by eLoanWarehouse. Many borrowers appreciate the quick approval process and easy access to funds, especially during emergencies. Positive feedback often highlights the helpful customer service and the convenience of managing loans through the company’s online platform.

However, some customers express concerns about the high APRs and limited dispute resolution options due to tribal sovereignty. While these loans can be lifesavers in emergencies, they come with significant costs that need careful consideration. Learning from the experiences of others can help new borrowers make informed decisions.

Conclusion

eLoanWarehouse offers a practical solution for those needing quick cash but carries both benefits and risks. Its fast approval process, flexible repayment terms, and accessibility to individuals with poor credit make it an attractive option for many. However, borrowers should be aware of the high-interest rates and legal limitations tied to tribal lending before making a commitment.

Ultimately, the key to using payday loans like eLoanWarehouse responsibly is understanding your financial situation and exploring all available options. By weighing the pros and cons, borrowers can make better decisions that help them manage their short-term financial needs without jeopardizing their long-term financial stability.